Before I tell you how to recover money after being scammed on social media, let me tell you how often it’s happening nowadays.

In 2023, an estimated 4.9 billion people use social media across the world. The number of people on social media has swelled to a record 4.9 billion globally.

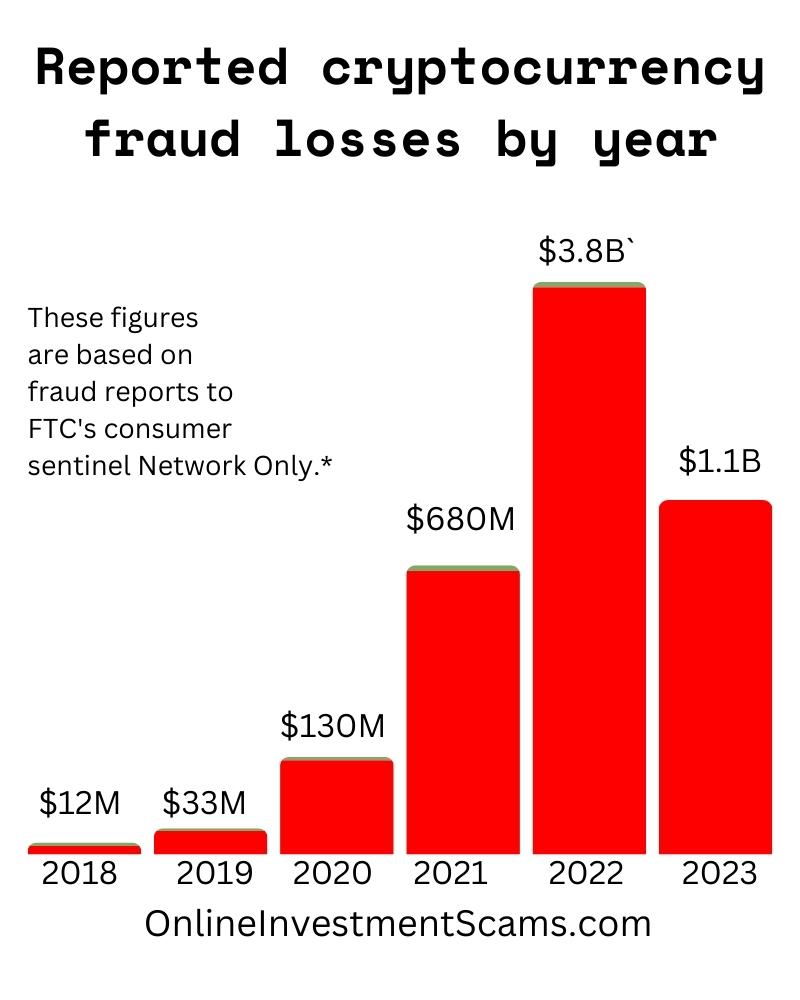

If we look at the crypto scams, this is increasing over time. Look at this research:

Furthermore, by 2027, this number is predicted to increase to 5.85 billion users, which means that there will be more scammers trying to steal your money through social media platforms.

According to the Federal Trade Commission (FTC) report, online scammers stole 8.8 billion dollars from consumers in 2022; that’s a 30% increase from 2021. The agency’s new report says more than a third of those were bogus cryptocurrency investments.

Scams on social media, whose adoption and usage are both growing globally, are one of the most pervasive cyber threats.

Scammers use websites and apps like Twitter, Facebook, Instagram, Snapchat, Telegram, and others to deceive and manipulate unwary users into giving them money or personal information.

Since everyone wants to make money, scammers can take advantage of this desire by making offers that actually entice people to give up their cash.

For instance, they might tell you to quickly double or 100x your money. Who would reject this offer if you prove yourself legit?

Keep in mind that not everything you see on social media is real. The same is true of people; they may show you the luxuries of their lifestyle in an effort to make you feel less worthy and convince you to spend money to live like them.

In this article, I will share some tips with you on how to get your money back if you have fallen victim to a social media scam, as well as some warning signs of ongoing social media scams.

Even if you have been scammed in crypto we found the best Bitcoin recovery expert to recover scammed Bitcoin.

On this page

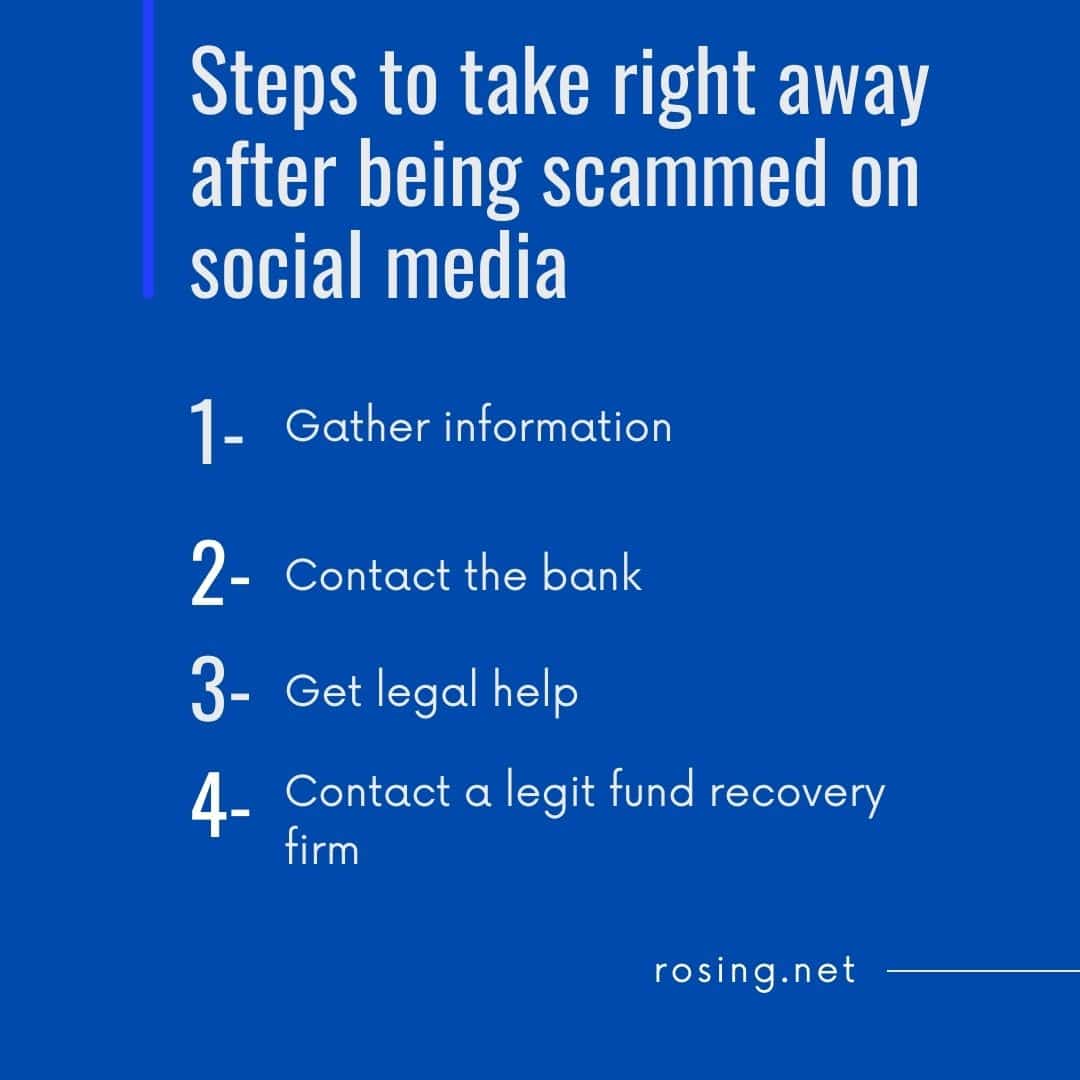

Steps to take right away after being scammed on social media:

If you discover that you have been conned, maintain your calm and collect all the relevant data, including the username, any conversations you may have had with the scammer, and the entire transaction history.

If you paid with a credit card or bank transfer, your bank or credit card company might be able to help you recover some of your losses.

If the scammer can be located and accused of a crime, you might also be able to get your money back through illicit repayment.

Use trusted legal channels rather than making an effort to get your money back on your own.

Following are the simple ways to get your money back:

1. Gather information:

Gather all the information related to the scam. For instance, if the scammer emailed you, you must provide printed copies of the email for reference. The emails contain data that could help identify the criminal. Include screenshots of the chat along with the username if you had a conversation on a social media site like Instagram or Snapchat.

Make a timeline of your interactions with the fraudsters as well as the precise sum of money you sent to them. You can use receipts, bank records, or credit card statements, which could be helpful for the bank to take further action.

2. Contact the bank or financial institution:

Get in touch with your bank or financial institution like your cryptocurrency exchange as soon as possible. You may be able to recover some or all of your money.

In case of a bank, inform the bank right away if you believe that your personal or financial information may have been misused, or if you see any suspicious activity on your account.

Give the scam’s details in chronological order. Give as much information as you can, such as the transaction’s date and amount.

Your bank or credit card provider will most likely start an investigation into the fraud.

For instance, a copy of the police report can be required by your bank or credit card company. Send it off as soon as you can. You might also be able to take it in person to a nearby branch.

Keep a record of all communications you send to your bank or credit card company, as well as any phone calls you make, their names, the times and dates they were made, and the content of those conversations.

If your bank or credit card company refuses to refund your money after providing enough evidence, you can forward the complaint against the bank to the Consumer Finance Protection Bureau (CFPB), which protects consumer rights and can help get your money back.

3. Get legal help:

Call the local police department to report a crime. The local police will be more likely to look into the scam if you have sufficient proof of your communications with the con artists.

You should gather as much information as you can that could help investigators find the criminal. If the scam happened online, keep the original digital copies of any emails or messages you received, along with any screenshots or printed documents.

After making a report to the police. Make copies of your written report as soon as you receive it. It can be required by your bank, credit card provider, or other government agencies.

Inform the Internet Crime Complaint Center (IC3) about the fraud. This will make it easier for law enforcement to identify and pursue scammers.

The FTC carries out investigations and gathers data to bring charges against con artists. You may be able to receive some of your money back as a result of an FTC action or settlement. You can file a complaint through the FTC website’s complaint page.

4. Contact a legit fund recovery firm:

There may be talks about asset recovery scams that actually take place to scam the victims again when these companies email or text you out of the blue because they already have a list of people who have been scammed. However, there are legitimate fund recovery companies like Online Investment Scams, which allow users to report instances of online fraud and ensure that the criminals are brought to justice.

If you have fallen victim to an online scam, keep in mind that recovery is possible and you do not have to handle it alone. “Online Investment Scams” is your ally, your champion, and your lighthouse, and it will unquestionably assist you in getting your hard-earned money back.

How to spot social media scams:

By looking for the following traits in a social media profile or message, you can determine whether it is genuine.

- The account’s history

- how many subscribers a certain account has

- mistakes in grammar and spelling

- A strange language

- A poor format

- If you are familiar with the profile,

- links contained in unsolicited mail

- offering you a way to make quick, easy money with little risk or effort

- posts, advertisements, or redirects to shops with enticing sales

- Strong requests for communication through phone or text

How to protect yourself from social media scams:

The first golden rule is to never give money or personal information to someone you have not met in person and only interact with trusted and verified businesses.

Watch out for romance scams on dating apps and red flags like poor grammar and refusing to video chat, and also be aware of anyone asking for payments in gift cards or cryptocurrency.

If you click on malicious links or download files from dubious sources, your computer could become infected with malware, viruses, or other cybersecurity threats. Keep an eye out for danger

Finally, don’t invest without doing a thorough research and contacting a financial advisor.

Despite the fact that social media scams are a serious concern in today’s digital environment, you can protect yourself by exercising caution, following best practices, and educating both yourself and others.

You can use social media safely and gain from its many benefits without falling victim to scams by being aware of the warning signs, protecting your personal information, and using caution online.