If you are in crypto trading, you might see many coins pump every day. Even on the top exchanges like Binance and Kucoin, we see tons of pumps every week. The good news is that you can catch those pumps secretly.

Here is how to figure out when a coin is expected to pump, how long it will go, and how you can also enjoy the ride along with crypto whales.

All the coins follow patterns. If a coin is constantly dropping, the coin will surely pump one day. But the question is when the coin will pump and how you can safely enter.

I will share two methods for finding pumps that I have learned by understanding the patterns of tons of coins.

If you want to find big pumps, there are two major steps.

Find the coin that has the potential to run hard

Finding such coins isn’t hard. There are many ways to find those coins.

- Every coin that goes up comes down. For instance, if a coin has pumped today, it’s more likely to dump hard, and then pump again in the following few weeks. So you can keep data of all those coins.

- Many traders share pumps on Twitter. You can research and see which coins are they sharing, and why they believe those can pump. Many traders draw trend lines to share how long the coin will go. You can keep that record with you.

- You can browse all the coins and find those coins which are constantly dropping in a specific pattern. I will discuss two secret methods to see which pattern is hinting at the pump.

Two popular candle stick patterns that definitely pump

There are two candle stick patterns that are supposed to hint at pumps.

1. Bull flag pattern

There is a popular pattern that pumps almost all the time; it’s called the bull flag pattern.

Here is what it looks like.

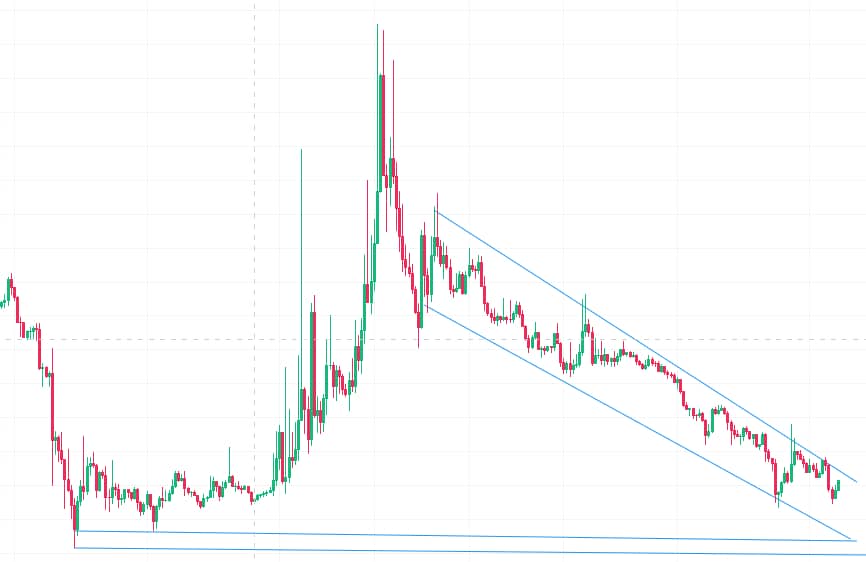

It’s a 4H graph of a coin Beta Finance, that’s more likely to pump soon.

You can see that it’s building flag downward, that’s called the bull flag. It means the bears want to push the price down but the bulls want to pump it at every point. There is a fight between bulls and bears.

In the end, the bulls win most of the time.

There are three questions that arise in the mind.

- When will the coin pump?

- What’s the best entry point?

- How long will it go?

The answer to the first question is, the coin is more likely to pump from the strongest support. It’s usually the last support level from where the coin was pumped earlier. It’s given in the photo on a bigger scale.

The other question is also important, What’s the safest point to enter the pump?

The safest point is to wait until a candle closes above the upper line of the bull flag. Then retests the line, reverses, and closes above the line (more accurately you should wait until it closes above the previous candle because sometimes whale fake out the lines to catch your investments).

Now the other important question is, how long will it go?

It often goes above the top of the bull flag. But it’s wise to exit on the top of the bull flag. Because sometimes you can’t sell due to liquidity issues later.

2. Big dump pattern

The other important pattern that hints at a big pump is the big dump pattern. This is what I have caught myself.

Here is what it looks like.

This is also a graph of Beta Finance. It was dumped a few days ago, then it was pumped again.

Here is how you can enjoy the pump.

One coin drops instantly, and that often happens on each level.

You should see where the candle closes. Now, the next candles should retest the point but should cross the previous line. You have noticed that there is strong support here. I have mentioned the support level with double lines.

Now, when next time, it will retest that support level and closes above the support level, it’s more likely to pump hard and will go above the point from where it was dumped.

You can see the graph to understand how it happened with the Beta Finance coin.

If you draw a trend line on the green candles on the retest, you will also see how long it will go. I have also drawn that trend line on it.

However, you should make sure that the retest is confirmed otherwise, you might get trapped. Here is a clue to make sure the retest is confirmed.

If you are working on 4H candles, you should see if it has touched the support on 1H twice and reversed. When it closes above the local high, you can enter.

Above all, you should keep in mind that crypto is highly volatile and it can involve the risk of losing money. So you should invest what you can’t manage to lose.

This page is not financial advice but sharing what I have noticed works 99%.